Quiz – Market Volatility vs Risk

What’s the Difference Between Market Volatility and Risk?

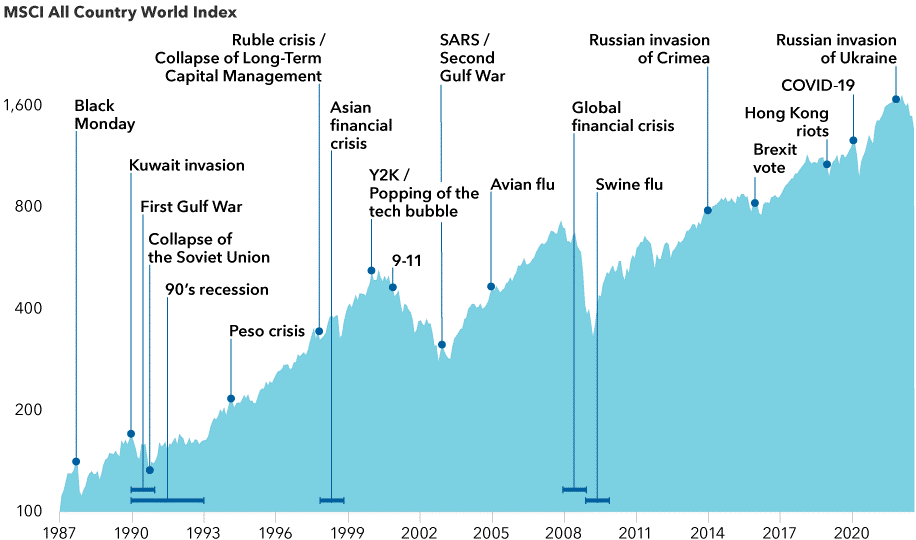

While volatility is not the same as risk, the chances of incurring a loss may increase during periods of market volatility, in large part, that’s because investors become anxious about falling share prices and sell when they might be better off holding.

See what you know about the difference between risk and volatility by taking this brief quiz.

1. What is market volatility?

a. Asset prices rising over a period of time.

b. Asset prices falling over a period of time.

c. The frequency and size of asset price swings, higher and lower.

d. A measure of how easy it is to buy and sell stock.

2. What is risk?

a. The chance of losing some or all of an investment.

b. The chance that actual investment returns will be different from anticipated investment returns.

c. A vulnerability that can be managed through asset allocation and diversification.

d. All of the above.

3. How can the effects of stock market volatility be limited?

a. By timing the market

b. By avoiding bonds

c. Through asset allocation and investment diversification

d. By avoiding stocks

4. Which famous investor said, “When people are desperately trying to sell, I buy. When people are desperately trying to buy, I sell. It has worked out very well over the years.”

a. Warren Buffett

b. Abby Joseph Cohen

c. Sir John Templeton

d. Abigail Johnson

Answers: 1) c1; 2) d2; 3) c3; 4) c4

If you feel overwhelmed and uncertain because of volatile markets, give us a call. You don’t have to go it alone! We can help you make sound decisions during difficult times.

Not a Cornerstone client?

Discover what’s possible when our 140 years of combined team experience and 30 years in business goes to work for you! Call 605-352-9490 or email cfsteam@mycfsgroup.com.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Sources

1 https://www.forbes.com/advisor/investing/what-is-volatility/

2 https://www.investopedia.com/terms/r/risk.asp

4 https://novelinvestor.com/quote-author/john-templeton/

CSP #242150 07.18.23