AVOIDING SPOUSAL BENEFICIARY MISTAKES

5 Easy Steps

Cornerstone is pleased to bring you this article by Ed Slott and Company, LLC, an organization providing IRA education and analysis to financial advisors, institutions, consumers, and media across the country. Our association with this organization helps us stay up to date on the latest developments in IRA and tax law. As always, give us a call if you’d like to discuss!

Who is a spouse beneficiary?

A spouse beneficiary:

- Must be married to the account owner at the time of the account owner’s death, and

- Must be named on the beneficiary form (or inherit directly through the document default provisions).

As a spouse beneficiary you have unique options:

1. Split the inherited account if necessary. As a spouse beneficiary, you can take advantage of the special spousal rules if you are the sole beneficiary of an IRA account.

If other beneficiaries have been named, the spouse can still take advantage of these special provisions by transferring their portion of the inherited IRA to a separate account by December 31st of the year following the year of the IRA owner’s death.

2. Will you need money prior to age 59½. If so, you will likely want to remain a beneficiary of the inherited account. Death is an exception to the 10% early distribution penalty. So, by staying as a beneficiary you can avoid paying the 10% penalty.

The account should be retitled as a properly titled inherited IRA. As a spouse that remains a beneficiary you do not need to take RMDs from the account until the year the deceased spouse would have turned 73.

3. Transfer the inherited IRA into a spouse beneficiary’s account. As a spouse beneficiary you should generally roll the inherited IRA into your name. Once a younger spouse beneficiary reaches age 59½, there’s no advantage to remaining a beneficiary, and a spousal rollover or transfer should be done.

NO other beneficiary has this option. By doing this rollover or transfer, a surviving spouse ensures that eligible designated beneficiaries will be able to stretch distributions over their own life expectancies.

4. Name new beneficiaries. As the surviving spouse you should name your own beneficiaries. If no beneficiaries have been named and the surviving spouse dies, the remaining assets will pass according to the default provisions in the custodial document. This is frequently the estate of the now deceased spouse, which could require a shorter payout period for beneficiaries or add unnecessary time and expenses by tying the assets up in probate.

5. Consider a disclaimer. Before taking any action regarding an inherited IRA, as a surviving spouse you should evaluate whether a full or partial disclaimer would be advantageous. By using a disclaimer, some or all of the inherited IRA can be passed to contingent beneficiaries, potentially extending the stretch IRA and reducing the future impact of estate taxes for eligible designated beneficiaries.

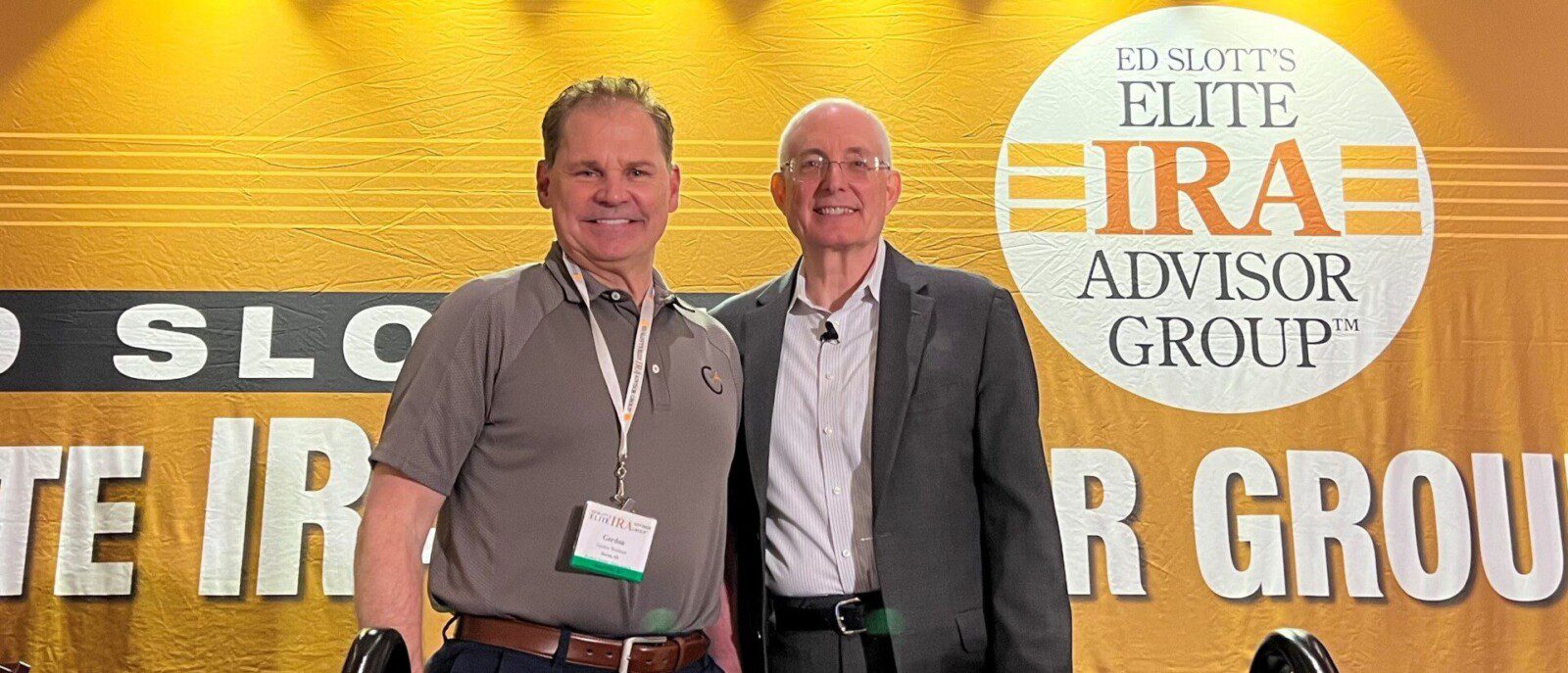

Gordon Wollman, Founder and President of Cornerstone Financial Solutions, and Raymond James Wealth Advisor, with Ed Slott at the 2023 Spring workshop for members of Ed Slott’s Elite and Master Elite IRA Advisor Group℠.

Membership in Ed Slott’s Elite IRA Advisor Group(T) is one of the tools our advisors use to help you avoid unnecessary taxes and fees on your retirement dollars. Gordon attends in-depth technical training on advanced retirement account planning strategies and estate planning techniques. And semiannual workshops analyzing the most recent tax law changes, case studies, private letter rulings, Congressional action and Supreme Court rulings help keep attendees on the cutting-edge of retirement, tax law and IRA distribution planning. Through his membership, Gordon is immediately notified of changes to the tax code and updates on retirement planning, and he has 24/7 access to Ed Slott and Company LLC to confer with on complex cases.

This information, developed by an independent third party, has been obtained from sources considered to be reliable, but Raymond James Financial Services, Inc. does not guarantee that the foregoing material is accurate or complete. Changes in tax laws or regulations may occur at any time and could substantially impact your situation. ACKNOWLEDGMENT: This article was published by Ed Slott and Company, LLC, an organization providing timely IRA information and analysis to financial advisors, institutions, consumers, and media across the country and is distributed with its permission. Copyright 2023, Ed Slott and Company, LLC. Raymond James is not affiliated with and does not endorse the opinions or services of Ed Slott or Ed Slott and Company, LLC.

Raymond James is not affiliated with and does not endorse the opinions or services of ED Slott, Ed Slott and Company, LLC, IRA Help, LLC, or Ed Slott’s Master Elite IRA Advisor Group. Members of Ed Slott’s Elite IRA Advisor GroupSM train with Ed Slott and his team of IRA Experts on a continuous basis. These advisors passed a background check, complete requisite training, attend semiannual workshops, webinars, and complete mandatory exams. They are immediately notified of changes to the tax laws.

CSP #231877-2 Exp. 10.23.25